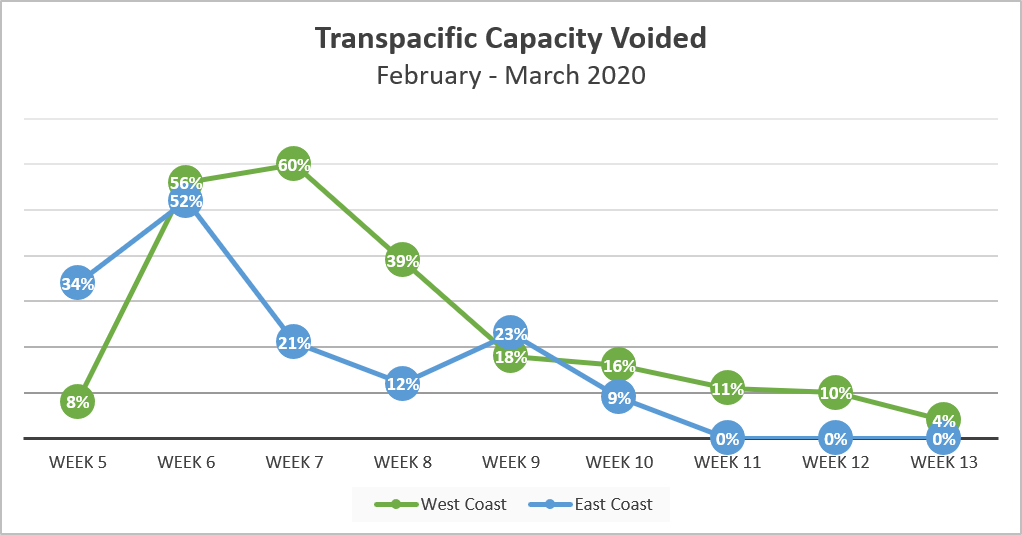

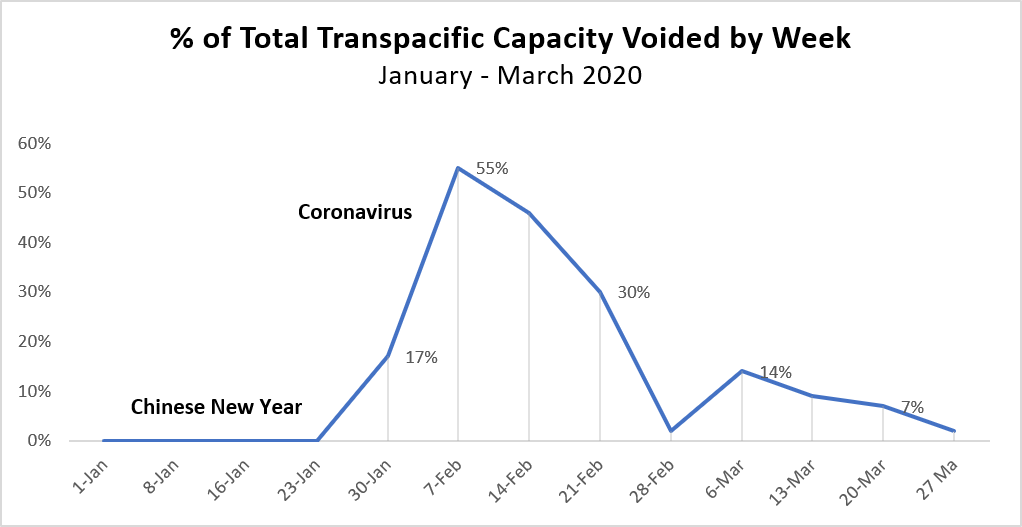

As China struggles to resume normal trade operation amid the deadly Coronavirus outbreak, carriers have planned and executed over 90 blank sailings from Asia to the U.S. between February and March, totaling over 800,000 TEU in capacity. The charts below show the impact of the blank sailings on Transpacific trade.

While the data above suggests that blank sailings peaked in February, we cannot rule out another spike in blank sailing activity, especially if virus containment measures prove ineffective.

This leaves many shippers questioning the short- to mid-term state of capacity in the Transpacific lane. Although difficult to predict, we will attempt to answer some of those questions.

Q: When will normal trade resume?

A: This is a difficult question to answer as the situation has been complicated by the further spread of the virus to 52 countries – including South Korea, Japan, and Italy. However, we anticipate export volumes from China will increase slowly throughout the month of March, and April and May should see a strong surge in volume. We will likely see residual effects of market recovery well into the peak season, even into September.

Q: Will blank sailings continue even if volumes return?

A: This is unlikely, as carriers will be anxious to recoup losses sustained as a result of the epidemic.

Q: Will carriers deploy extra loaders to help clear the backlog?

Major carriers have indicated that they would deploy extra loaders if capacity is available.

Q: Will the volume surge only affect exports from China?

A: A surge in volume will not only impact China, but the entire global economy will feel its impact as well due to heavy reliance on components and raw materials sourced from China. As a result, we expect global exports to surge in concert with China’s recovery. Ports in Southeast Asia may also experience equipment shortages and transshipment delays over the coming months as carriers will likely prioritize full container exports and empty equipment repositioning in direct load ports throughout mainland China.

Q: How will market rates be affected by the surge in demand?

We expect short-term spot rates to spike starting mid-March, with more substantial increases in April and May. While it’s difficult to accurately estimate how much spot rates will increase, it is likely that we will see rates similar to what we saw in 2018 during the pre-tariff rush, with rates increasing by more than $1,000/FEU.

BCO’s under long-term contracted rates should expect to see temporary PSS charges or accept FAK / spot rates to prevent rollover as carriers will likely charge a premium for cargo space during the volume surge. The surge in spot rates will likely coincide with the traditional contract negotiation period, making for a challenging negotiating environment. While it’s still too early to predict where the long-term rate market is heading, BCO’s should not expect to see net reductions in 2020.