UNDERSTANDING NORTH AMERICA’S

NEW TRADE DEAL

The United States – Mexico – Canada Agreement (USMCA) free trade agreement took effect on July 1, 2020, replacing the NAFTA agreement.

For businesses engaged in cross-border trade with Canada and Mexico, this means new opportunities as well as new risks as they navigate the new rules and regulations of the new U.S. – Mexico – Canada Agreement.

USMCA Overview

What is USMCA?

The United States – Mexico – Canada Agreement (USMCA) is a trade agreement between the United States, Mexico, and Canada. USMCA replaces the North American Free Trade Agreement (NAFTA), which has been in effect since January 1994. NAFTA sought to eliminate tariff and non-tariff related trade and investment barriers between the three North American countries, and tariffs on various agricultural products, textiles, automobiles, and other goods were either reduced or eliminated.

USMCA preserves NAFTA’s trilateral trade pact and modernizes the trade relationship by:

- Addressing developments in technology and trade practices

- Adding new criteria to certain commodities, including textiles and automotive goods

All goods entered into commerce will receive preferential treatment under USMCA, only if preferential treatment is claimed.

It is important to note that USMCA is referred to by different names in Canada and Mexico. In Canada, it is called the Canada-United States-Mexico Agreement (CUSMA), while in Mexico it is referred to as the Tratado entre Mexico Estados Unidos y Canada (T-MEC).

What’s Changed Since NAFTA?

NAFTA eligibility and procedures will cease to apply and will be replaced with a number of new procedural terms.

While the new USMCA Agreement modernizes many of NAFTA provisions, it also features new provisions related to automotive goods, dairy, agricultural produce, homelessness, manufactured products, labor conditions, and digital trade, among others.

USMCA will not change the zeroed-out tariffs on most manufacturing and agricultural goods.

New USMCA Provisions

Dairy

- The dairy provisions give the U.S. tariff-free access to 3.6%, up from 3.25%

- Canada agreed to eliminate Class 7 pricing provisions on certain dairy products and raise the duty-free limit to $150, from the previous $20 level

De Minimis

- Canada will raise its de minimis level from $15.38 to $30.77 for taxes and provide for duty-free shipments up to $115.38

- Mexico will continue to provide $50 tax-free de minimis and duty-free shipments up to $117

Labor

- Mexico is required to pass legislation that improves the collective bargaining capabilities of labor unions

- Minimum wage requirement for automotive industry: 40%-45% of autos must be manufactured in a factory that pays a minimum of $16 per hour

Local Presence

- Elimination of Foreign Office and Local Presence requirements

- The USMCA sunset clause would eliminate the need for companies to establish foreign office or local presence requirements in any other USMCA country

Intellectual Property

- Copyrights will be extended to life plus 70 years and 75 years for sound recordings

- Trademarks will be protected for 10 years (renewable)

- Biotech firms would have at least 10 years exclusivity for agricultural chemicals

- The industrial designs period would jump to 15 years

Sunset Clause

- There is a stipulation that the agreement itself must be reviewed by the three nations every six years, with a 16-year sunset clause

- The agreement can be extended for additional 16-year terms during the six-year reviews

Dispute Settlement

- Chapter 20 is the country-to-country resolution mechanism

- Chapter 19 handles disputes of anti-dumping or countervailing duties

- Chapter 11 is the investor-state dispute settlement mechanism

Automobiles

- 75% of auto content be made in North America, up from 62.5%

- 40-45% of qualifying vehicles must be produced by employees making an average of $16 per hour

- At least 70% of overall annual purchases of steel and aluminum must be sourced from North America

Claims for Preferential Tariff Treatment

Making a Claim

When making a claim under USMCA, continue using Entry Type 08, which will be renamed Entry Type 08, USMCA Duty Deferral. When filing a claim, the Filer certifies that the goods comply with all Rules of Origin (RoO) and record keeping requirements.

The Special Program Indicators “MX” and “CA” used by NAFTA are replaced with “S” and ”S+” for USMCA claims.

| Special Program Indicator (SPI) |

Special Column Designation |

Items eligible for preferential tariff treatment will be indicated with a new Special Program Indicator (SPI) of “S”.

|

|

USMCA preference may also be claimed on unconditionally free tariff items in order to receive an exemption from Merchandise Processing Fees (MPF), provided the goods meet all requisite USMCA requirements.

|

|

An “S+” SPI designation will also be available.

|

Merchandise Processing Fees (MPF)

Claims for Merchandise Processing Fees (MPF) exemptions must be made at time of entry.

- This includes both originating and tariff preference level goods

Currently, MPF refunds on post importation claims are not permitted under USMCA. This restriction applies to both individual and reconciliation filings.

- Legislative remediation is needed to reverse this policy and allow refunds

Post-Importation Claims

Importers can file a post-importation claim to request a refund of excess duties paid on qualifying goods, pursuant to 19 USC 1520(d). There are no changes to requirements between NAFTA and USMCA.

- Eligibility: Good qualifies for preferential treatment

- Effective Period: One year after date of importation

- Responsible Party: Importer

Post-importations claims must include the following documents:

Claim Deficiencies and Corrections

Deficiencies

Post-importation claims will be denied, with a statement specifying deficiencies, if any of the following apply:

- Certificate of Origin is illegible, incomplete, or contains incorrect information

- Claim does not comply with requirements

Corrections

Corrections are allowed on post-importation claims up to the one-year expiration period.

Exception: Corrections will not be permitted if the claim has already been reviewed and decided upon.

NOTE: Post-summary corrections are not allowed for USMCA claims.

Reconciliation

Importers can flag an Entry Summary for a post-importation claim under USMCA for Entry Type 09 at the time of filing.

While reconciliation entries are not mandatory, it is the only way to file a USMCA claim once an Entry Summary is flagged.

After flagging an Entry Summary, any separate filing of a USMCA claim will be considered duplicative and will not be accepted.

Duty Drawback

Summary of USMCA Changes

Substitution Standards

Substitution Standards

TFTEA Substitution Standards have been adopted when drawback is permitted

(i.e., “substitution” under the same 8-digit HTSUS subheading instead of “same kind and quality substitution”).

Conditions of Export

Conditions of Export

The NAFTA provision that applied a fee pursuant to

Section 22 of the U.S. Agricultural Adjustment Act, subject to Chapter Seven (Agriculture and Sanitary and Phytosanitary Measures) has been removed.

ACE Indicator

ACE Indicator

The NAFTA provision that applied a fee pursuant to

Section 22 of the U.S. Agricultural Adjustment Act, subject to Chapter Seven (Agriculture and Sanitary and Phytosanitary Measures) has been removed.

Section 201, Section 301 Duties

Under USMCA, drawback Filers can still submit claims related to Section 201 and/or Section 301 duties.

Filers are required to provide the following numbers on all claims:

- The Chapter 99 HTSUS tariff number related to the Section 201 and/or 301 duties, and

- The associated Chapter 1 to 97 HTSUS tariff number

I already filed a Section 201 or Section 301 claim. Now what?

If a Section 201 and/or Section 301 claim was previously filed and accepted in ACE, Filers are required to “perfect” the claim. To “perfect” a claim, Filers are requested to contact their Drawback Specialist and request the claim be returned to trade control. Filers will then need to update the claim to reflect both of the HTSUS tariff numbers (described above) and resubmit to CBP within 5 business days.

For more information, please see Cargo Systems Messaging Service #19-000050

Country of Origin

Rules of Origin

Rules of originating status have remained the same for most commodities. However, there are significant changes to certain commodities, including automotive and textile apparel. Under USMCA, a good is considered originating when:

- The good is wholly produced or obtained entirely in the territory of one or more of the Parties

- The good is produced entirely in the territory of one or more of the Parties exclusively from originating materials

- The good is produced entirely in the territory of one or more of the Parties using non-originating materials, provided the good satisfies all applicable requirements of product-specific rules of origin

- The good satisfies all other applicable origin requirements

- Except for goods provided for in HTSUS Chapters 61 to 63, the good is:

- produced entirely in the territory of one or more of the Parties;

- is classified with its materials or satisfies the “unassembled goods” requirement;

- meets a regional value content threshold of:

- not less than 60%, if the transaction value method is used; or

- not less than 50%, if the net cost method is used (not including RVC for autos)

Certificate of Origin

Under USMCA, a Certificate of Origin may be submitted by either the Importer, Exporter, or Producer.

The Certifier must have supporting documentation which demonstrates the good’s origin and records must be kept for five years from the date of entry. While NAFTA certificates are no longer required, previous NAFTA certificates and certification documentation must be kept for a minimum of five years.

The certification can cover one shipment or a series of shipments within a 12-month period. NOTE: A Certificate of origin is not required for imports valuing less than $2,500.

There is no specific format or USMCA form required for a Certificate of Origin. The information can be made available on any document, including a commercial invoice, as long as it contains the data elements described below. Please note that a commercial document issued by a non-USMCA Party will not be accepted as certification of origin. For your convenience, we recommend that you use the form below to ensure consistency and compliance.

Required Data Elements

The following data elements are must be listed on all USMCA Certificates of Origin:

- The Certifier must note whether they are the Importer, Exporter or Producer of the good

- Certifier’s name, title, address, email address, and phone number

- Exporter’s name, address, email address, and phone number

- Producer’s name, address, email address, and phone number

- Importer’s name , address, email address, and phone number

- Product description and six-digit HS tariff classification number

- Origin criteria under which the good qualifies

- Blanket period

- The certification must be signed and dated and include the following statement:

“I certify that the goods described in this document qualify as originating and the information contained in this document is true and accurate. I assume responsibility for providing such representations and agree to maintain and present upon request or to make available during a verification visit, documentation necessary to support this certification.”

Country of Origin Markings

For marking purposes, the Rules of Origin (RoO) contained in 19 CFR 102 determine the country of origin for goods imported from Canada or Mexico.

For most goods, only product-specific RoO contained in GN 11 is needed to determine whether a good is originating.

Changes from NAFTA

Goods, with the exception of certain agricultural goods, no longer need to qualify for marking as a good from Canada or Mexico in order to receive preferential tariff treatment.

Goods with a non-foreign origin (i.e., a U.S. origin good) are also eligible for preferential tariff treatment, and the U.S. will now be accepted as a country of origin on USMCA claims.

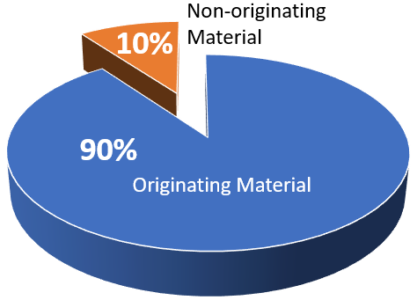

De Minimis for Non-Textiles

The de minimis provision allows a good to qualify as originating if it contains no more than 10% of non-originating materials, including goods subject to RVC requirements.

Under de minimis guidelines, the value of all non-originating materials used in the production of the good cannot exceed 10% of either:

- The transaction value; or

- The total cost of the good

RVC Requirements

If subject to RVC requirements, the value of de minimis materials is included in the total value of non-originating materials.

Goods that qualify for de minimis are not required to satisfy RVC requirements, provided the good satisfies all other applicable requirements.

Treatment of Sets

Goods put together in sets for retail sale (that are classified as a result of the application of General Rule of Interpretation 3) are considered originating if:

OR

Except as provided for in the product-specific Rules of Origin in GN 11.

Transit and Transhipment

An originating good will retain its status if it has been transported directly to the United States without passing through the territory of a non-USMCA Party.

If an originating good is transported outside the territories of the participating USMCA Parties, the good will retain its originating status if the good:

- Remains under customs control in the territory of the non-Party; and

- Does not undergo an operation outside the territories of the Parties other than:

or any other operation necessary to preserve it in good condition or to transport it to the territory of the Importing Party.

U.S. Customs and Border Protection

USMCA Center

To help coordinate implementation of USMCA, CBP opened the USMCA Center. Staffed with CBP experts from operational, legal, and audit disciplines in collaboration with Canadian and Mexican customs authorities, the USMCA Center will serve as a central communication hub for CBP and the private sector community, including traders, brokers, freight forwarders and producers, ensuring a smooth and efficient transition from the North American Free Trade Agreement to USMCA. Visit their website located at https://trade.cbp.gov/USMCA/s/ for more information.

CBP has also compiled USMCA-related resources for members of the trade community on their website, located at www.cbp.gov/trade/priority-issues/trade-agreements/free-trade-agreements/USMCA.

CBP Fact Sheets

CBP has posted a series of fact sheets which highlight the significant changes in USMCA and offer a detailed side-by-side comparison to NAFTA. CBP’s fact sheets are for comparison or advisory purposes only and are not legally binding. A list of available CBP fact sheets with links is provided below:

CBP Information Center

USMCA Center (Email Address): USMCA@cbp.dhs.gov

AskCBP Search Engine: https://help.CBP.gov

CBP Call Center: 877.227.5511