What Are Incoterms?

Incoterms are an internationally recognized set of terms that define the responsibilities and obligations of the parties involved in the transport of goods. Incoterms are used to clearly communicate the division of the cost of carriage and risks associated with the international transportation and delivery of goods between the seller to the buyer.

Incoterms were first introduced in 1936 by the International Chamber of Commerce (ICC) as different practices and legal interpretations between traders around the world necessitated a common set of rules and guidelines for interpreting the most commonly used terms in foreign trade. Incoterms are revised periodically, roughly every 10 years, by the ICC to conform to changing trade practices.

What Incoterms Do

It is important to note that the Incoterms of a contract for sale pertain only to the delivery terms (carriage freight costs) and insurability of the product. Incoterms define the respective obligations, costs and risks involved in the delivery of goods.

What Incoterms Do Not Do

Incoterms by themselves do not:

- Specify the amount of the contract or the terms of financing

- Supersede the law governing the contract

- Address the transfer of ownership of the goods

- Determine when revenue is recognized

- Address the consequences of a breach of contract or exemptions of liability

These items are defined by the terms of the sales contract and the governing law.

Intercoms 2020 Defined

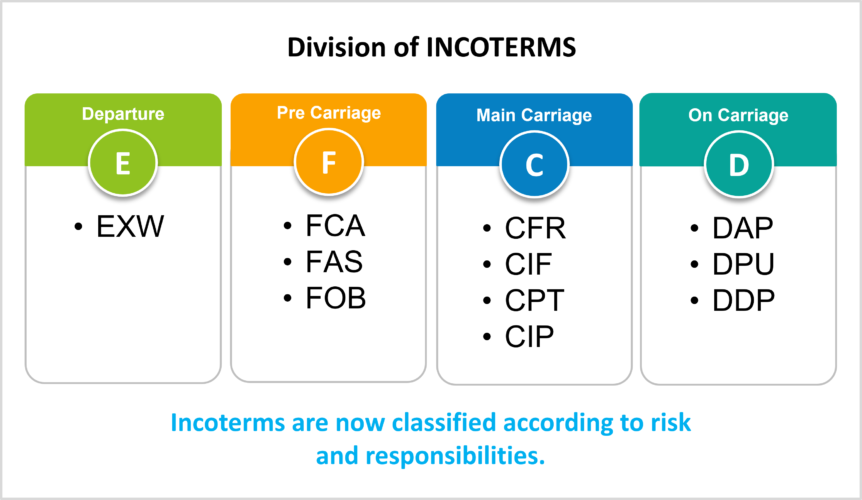

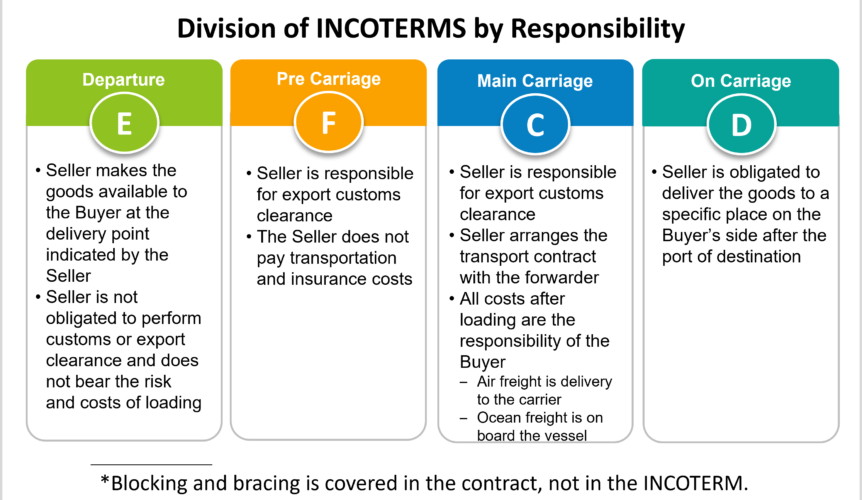

Group E: Departure

EXW – Ex Works

This term represents the seller’s minimum obligation, as the seller only has to make the goods available at its location. The seller does not load the goods on the collecting vehicle and does not clear the goods for export. The buyer bears all the costs for transportation, export and import duties, and cargo insurance, as well as the risks of bringing the goods to their final destination. The buyer also carries out all customs formalities.

Group F: Pre Carriage

FCA – Free Carrier

The seller delivers the goods to the carrier and clears the goods for export. Once the goods have been delivered to the carrier, the buyer takes over all the costs and risks. The buyer is responsible for procuring and paying for cargo insurance and all import formalities. FCA is the most commonly used Incoterm – it is used in ~40% of all international shipments. FCA is one of the most favorable terms for the buyer who wants to have control over costs at origin and international transportation through a nominated freight forwarder.

FAS – Free Alongside Ship

The seller delivers the goods alongside the vessel at the named port of shipment and is required to clear the goods for export. The risk of loss of or damage to the goods passes to the buyer when the goods are alongside the vessel. The buyer bears all costs from that moment forward, including loading the cargo on bard the vessel, and is responsible for procuring the cargo insurance and carrying out all import formalities. This term can only be used for ocean and inland waterway transportation.

FOB – Free On Board

The seller delivers the goods to the vessel nominated by the buyer, loads the goods on board the ship, and clears the goods for export. The risk of loss of or damage to the goods passes when the goods are on board the vessel, and the buyer bears all costs from that moment onward, including cargo insurance. The buyer is responsible for all import formalities. This term can only be used for ocean and inland waterway transportation. The FCA term was changed to allow the parties to agree to issue a Bill of Lading (BOL) to the seller once the goods arrive at the port.

Group C: Main Carriage

CFR – Cost and Freight

The seller arranges transportation and pays for the goods to be delivered to the final port of destination. The seller is responsible for clearing the goods for export. As the risk of loss of or damage to the goods passes to the buyer when the goods are loaded on board the vessel, the buyer is responsible for procuring and paying for the cargo insurance. The buyer is responsible for all import formalities. This term can only be used for ocean and inland waterway transportation.

CIF – Cost, Insurance and Freight

The seller clears the goods for export and covers the costs of insurance (to at least the port of destination) and main carriage while in transit to the port of destination named in the sales contract. The risk of loss of or damage to the goods passes to the buyer when the goods are loaded on board the vessel. The buyer is responsible for on carriage costs, all import formalities, and unloading costs. The buyer should note that the seller is only required to procure the “minimum” insurance coverage. This term can only be used for ocean and inland waterway transportation.

CPT – Carriage Paid To

The seller clears the goods for export and pays for pre carriage and main carriage to named place of destination. The seller may pay on carriage costs, which should be noted in the contract. The buyer is responsible for procuring cargo insurance and handling all import formalities. This term has 2 critical points because risk passes and costs are transferred at different places: 1) risk passes once the goods have been delivered to the nominated carrier at the agreed place of shipment at origin, and 2) the named place of destination to which the seller must contract the carriage.

CIP – Carriage and Insurance Paid

The seller clears the goods for export and pays pre carriage and main carriage to the named place of destination. The seller may pay on carriage costs, which should be noted in the contact. This term has been updated to require the seller to purchase “nearly maximum” insurance coverage that is equivalent to Clause A (Institute of Cargo Clauses). The risk passes to the buyer when the goods are loaded on the first truck. The buyer is responsible for all import formalities.

Group D: On Carriage

DAP – Delivered At Place

The seller pays for carriage to the named place of destination and assumes all risks until the goods are ready for unloading by the buyer. The buyer is responsible for all costs related to import clearance. Unloading is the responsibility of the buyer.

DPU – Delivered at Place Unloaded

DPU replaces the DAT term. The seller clears the goods for export and pays for pre carriage, main carriage and on carriage costs. The buyer is responsible for all import clearance formalities. DPU is the only Incoterm explicitly tasking the seller with unloading.

DDP – Delivered Duty Paid

This terms represents the maximum obligation to the seller. The seller is responsible for delivering the goods to the named place of destination. The seller bears all the costs and risks involved in bringing the goods to the place of destination and has an obligation to clear the goods for export and import and to carry out all customs formalities, including the payment of all duties, taxes and customs fees. The parties are advised not to use DDP if the seller is unable to directly or indirectly obtain import clearance.

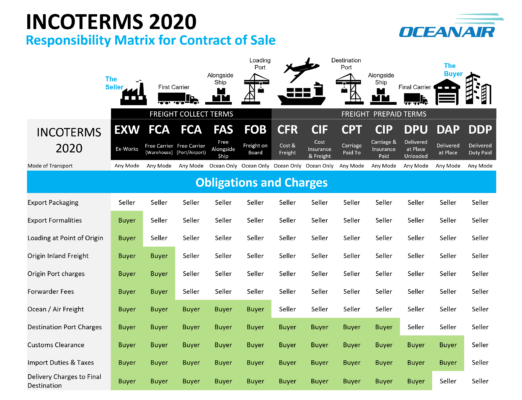

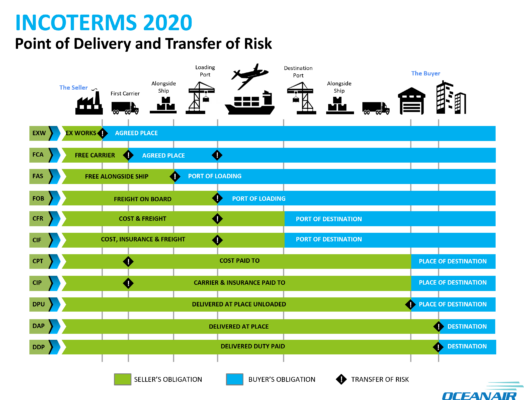

Obligations, Delivery, and Transfer of Risk

The charts below summarize the responsibilities of the buyer and seller, the point of delivery, and the transfer of risk for each of the Incoterms.

NOTE: The charts do not capture the full details of each term like the book can. The charts should only be used as supplemental guides to the official Incoterms® 2020 book.

Summary and Division of Incoterms® 2020

What’s Changed in Incoterms® 2020?

While it may seem that not much has changed, Incoterms® 2020 was revised to make the terms easier to understand in order to avoid situations were Incoterms are misinterpreted or mis-used, often with costly consequences.

1. DAT is Replaced with DPU

In Incoterms 2010, DAT (Delivered at Terminal) deemed the goods to be delivered once they had been unloaded at the named terminal. In Incoterms 2020, the term has been deleted and replaced with the DPU (Delivered at Place Unloaded) term in order to make the place of delivery more general.

2. FCA and Bills of Lading

The FCA term was changed to allow the parties to agree to issue a Bill of Lading (BOL) to the Seller for shipments financed by a letter of credit. The BOL can now be exchanged when the goods arrive at the port, once delivery has been deemed to occur.

3. Change of Insurance

The CIP term has been changed to require the seller to procure a higher level of insurance coverage – from the “minimum” coverage to “nearly maximum” Clause A (Institute of Cargo Clauses) coverage.

CIF keeps the same insurance requirements, which is the basic “minimum” level Clause C (Institute of Cargo Clauses).

4. Costs are Clarified

Costs have been clarified to respond to user feedback that there were increasing disputes over the allocation of costs between the seller and buyer, especially those at the port or place of delivery. The broad principle is that the seller is responsible for costs incurred up to the point of delivery while the buyer is responsible for costs beyond that. The allocation of costs now appear in the A9/B9 section of each rule.

5. Security Requirements

Cargo security has become increasing important since 9/11, and the 2020 rules now address many of the security-related requirements.

Security requirements have been updated to make security obligations, such as mandatory cargo screening, more prominent. Security-related allocations have been added to the A4 and A7 section for each rule.

6. Own Transport

Incoterms 2010 assumed that the transport of goods would be carried out by a third party carrier. They did not deal with instances where the transport was provided by the seller or buyer (e.g., seller’s own truck).

The terms now expressly state that sellers and buyers can provide their own transport for carriage from the named place of delivery. Buyers can contract for carriage or arrange their own transportation using the FCA rule while sellers should use any of the D rules.

7. Improved Presentation

The terms have been updated to include pictures and Explanatory Notes, which explain the fundamentals of each Incoterm, such as when the term should be used, when the risk passes from the Seller to the Buyer, and how costs and obligations are allocated between the parties.

The Incoterms have also been reordered so that the delivery obligation is now more prominent.

Putting INCOTERM® 2020 into Practice

1. Prepare for Incoterms® 2020

- Identify what Incoterms your business typically uses

- Check to see if the changes introduced by Incoterms® 2020 has any impact on your business

- Consider if you are using the right Incoterms – many businesses continue to use an Incoterm which is no longer suitable or relevant to their business needs

- Update your standard contracts to refer to Incoterms® 2020

2. Be Specific

When using Incoterms in a Contract for Sale or a Purchase Order, identify the appropriate Incoterm Rule (e.g., FCA, CIP, etc.), specify the place or port as precisely as possible, and state “Incoterms 2020” (e.g., FCA, Logan International Airport, Boston, MA, INCOTERMS 2020).

3. Understand Who Has the Responsibility for Loading and Unloading Charges

For DAP, DPU or DDP terms, the Seller is obligated to place the goods on the carrier which will deliver the goods to the named place of destination. The Buyer is responsible for unloading.

For CPT, CIP, CFR or CIF terms, the seller completes delivery when the goods reach the port or place of destination. Once the good have been delivered to the agree upon port or place, the Buyer takes over responsibility from that point forward.

Under FCA, the seller’s obligations are satisfied once the goods have been handed over to the the carrier named by the buyer at the agreed place, either the first truck or the port of origin. The buyer is responsible for inland freight, unloading at the port of origin, and loading on the ocean carrier/airline.

4. Know where the Risk of Loss Transfers

For EXW, risk transfers at the Seller’s facility or the agreed place, which is typically the first truck.

For FAS or FOB, risk transfers at the port of loading, once the cargo reaches the shipyard/terminal or is loaded on board the vessel/aircraft respectively, while FCA can either be the first carrier or the port of loading.

A common misconception buyers make when the seller pays the cost of freight is assuming that the seller takes on all the risk of loss until the goods have been delivered to the named place of destination or to the port specified on the air waybill or the bill of lading. When using CFR, CIF, CPT, or CIP, risk transfers to the buyer when the goods are handed over to the carrier at origin, which could be when the goods are loaded onto the first truck.

For DPU, DAP, or DDP risk transfers once the goods have been delivered to the place of destination.

5. Know Who is Responsible for U.S. Customs Entry Declarations

DDP is the only Incoterm that requires the seller to perform all U.S. Customs entry declarations.

For ocean freight imports to the U.S., it is important to note that an Importer Security Filing (ISF) must be electronically submitted to Customers 24 hour before the cargo is loaded onto the vessel. Buyers should specify in the contract either (a) the shipper is responsible for the ISF or (b) the seller is responsible for providing the required data in a timely manner (i.e., 72 hours period to lading) to the Buyer’s appointed Customs Broker. The buyer should also indemnify against the penalties for filing a late, inaccurate or incomplete ISF.

6. Where can I get a copy of ICC Incoterms® 2020?

You can buy the Incoterms® 2020 book at the International Chamber of Commerce’s website located at www.iccwbo.uk/pages/incoterms.