WE TAKE THE RISK

OUT OF SHIPPING

CARGO INSURANCE

Don’t leave your livelihood up to chance!

Let us protect and prepare you in the event that a loss occurs. Whether you ship by land, sea, or air, our cargo insurance provides solid protection from the moment your goods leave the warehouse until they reach their final destination. By leveraging OCEANAIR’s cargo insurance, we can help you to minimize risk and mitigate loss. If your cargo goes missing or your shipping container is damaged, you’ll be relieved to know your items are covered, and you won’t pay the price.

Our insurance policies are competitively priced and tailored to suit the specific transportation or protection needs of our clients. We can insure a single consignment or provide an open cargo policy to cover all of your transits for a period of one year. If your supplier has already placed insurance on your shipment, OCEANAIR can conduct an analysis to ensure proper coverage is provided. If the policy does not protect you against concealed damage, air freight replacement, repacking or reshipping expenses, or debris removal, OCEANAIR can provide a contingency policy to cover you against claims not covered under the existing policy.

In the event of a loss or damage, OCEANAIR can assist you in filing claims against airlines, steamship lines, truckers, or warehouses.

MITIGATING YOUR RISK

Protect Your Cash Flow

Peace of Mind

Efficient Claims Handling

UNDERSTANDING THE RISKS

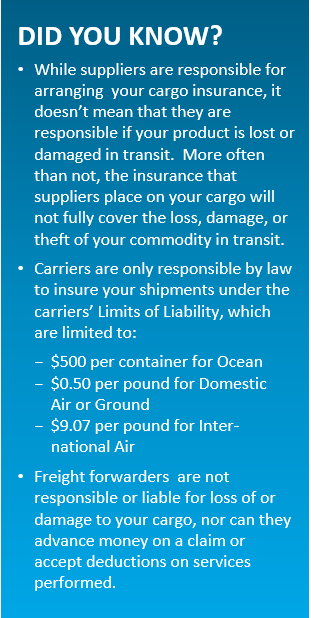

Shippers who rely on suppliers to furnish cargo insurance or who rely on their carriers to take responsibility for losses may be in for a big surprise. The risk of sustaining a loss in transit may be greater than you think.

Statistics show that one ship sinks every day, $30 billion in cargo theft occurs every year, and businesses will experience one General Average loss every eight years.

Ocean Freight

Why worry about General Average? Think it can’t happen to you? Think again! 2019 began with a series of major shipping accidents, including fires onboard the Sincerity Ace, Yantian Express, and APL Vancouver and the sinkings of the Grande America and the SL STAR. All of these vessels declared General Average, a contractual obligation of each shipper onboard to pay a portion of the expenses to save the vessel and its cargo.

Under General Average, the unlucky shipper whose cargo has been damaged is limited to the Carriage of Goods by Sea Act which limits a carrier’s liability to just $500 per shipping unit, which could be a full 40’ container! General Average claims are a huge risk for shippers even if their cargo is undamaged. Shippers can expect to pay upwards of 60% of the value of their cargo before the steamship line releases their undamaged cargo. Shippers that do not take out an insurance policy and who are unable to provide adjusters with the acceptable security could find their cargo auctioned off to recover the residual value of the cargo or be sued for costs and consequences.

Truck Freight

Think that ocean freight is the only mode of transport that can suffer a loss? Cargo theft from an unattended truck is seen as a low-risk, high-reward crime by would-be thieves. CargoNet reports that the average loss per incident is $254,800. Additional consequences of cargo theft include the cost of replenishment, refunds, and lost sales.

Did you know, in order to provide competitive rates, truckers’ limit their liability, and they are only responsible for losses for which they are negligent – so acts of god like an icy road, theft, or an accident caused by a 3rd party are not typically covered.

Air Freight

While the possibility of a disaster in the air is minimal, when midair calamity does strike, the results are often catastrophic.

Airlines limit their liability to around $26 per kilo for international freight and $0.50 per pound for domestic freight. Remember these liability limitations only exist if you can prove the airline was at fault.

OTHER CONSIDERATIONS

Who’s really responsible if your product is lost or damaged in transit? While under the CIF and CIP Incoterms, suppliers are obligated to procure insurance for your shipments, it doesn’t mean that they are ultimately responsible if your product is lost or damaged during transit. The ultimate burden of loss falls upon you, the buyer. For this reason, many experts recommend that shippers negotiate an EXW, FOB, FCA, or CFR term in order to control the selection and quality of insurance coverage.

How much is that insurance really costing you? Foreign suppliers and their forwarding agents often tack on placement fees to inflate the cost of insurance well above market price for the same

coverage purchased in the United States. Review your invoice to find out how much you’re really paying for your supplier to arrange insurance for you and then ask OCEANAR for a quote to compare.

Is the coverage your supplier purchased for you adequate? Shippers relying on their suppliers to arrange insurance run the risk of having inadequate insurance coverage. Cargo insurance is an

unregulated industry and cargo insurance policies vary widely in terms of coverage, deductibles, restrictions, and expertise. Ask your supplier for a full copy of the insurance policy or for a certificate of insurance detailing the policy’s terms and conditions.

What’s the financial health of your supplier’s insurance company? Recent events have exposed the vulnerability of insurance companies to sudden economic devastation. Shippers are encouraged to make certain their suppliers use insurers with a favorable financial rating supplied by a respected financial rating service, such as A.M. Best, Standard & Poor’s, and Moody’s. OCEANAIR’s insurance company, underwriters at Lloyd’s of London, has an A.M. Best financial rating of A (Excellent).

How will your claim be handled? If insurance is arranged overseas, you may find yourself dealing with an inexperienced, subcontracted adjuster who is unfamiliar with the assessment of transportation-related losses. Ask your supplier for a list of their contracted insurance claims adjusters. Adjuster and surveyor networks approved by Lloyd’s of London and AIMA are among the most credible.

Still not convinced? Got questions?

Contact your OCEANAIR Sales Representative at: