Global Shipping Crisis Q&A

Enourmous shipping delays and rising freight prices have severely damaged supply chains around the world.

You’ve got questions. We have the answers.

Where’s my freight?

Shippers are facing a “perfect storm” in the shipping market. Virtually every aspect of the supply chain is stretched to the limit due to:

- Increased demand

- Reduced capacity

- COVID-19-related disruptions

- Chronic port congestion

- Blank sailings

- Rolled cargo

- Chronic rail congestion

- Trucking delays

- Limited warehouse space

- Equipment shortages

- Labor shortages across all modes of transport

With deployed capacity failing to keep pace with growing demand, the rapidly spiraling shipping market has pushed up shipping rates as importers race to meet demand for everything from the raw materials and components that feed their supply chain to toys and electronics for the year-end holiday shopping season.

A recent analysis by the Russel Group, a risk modeling company, suggested that the amount of trade held up so far this year and moving into October could total $90 billion.

Why is manufacturing capacity reduced?

- Delays in China and Southeast Asia

- Efforts to control the spread of the Delta variant has led to a sharp decrease in manufacturing capacity in China, Vietnam, and Malaysia

- Capacity restrictions

- Temporary closures due minor outbreaks

- The Chinese government announced on September 27 that manufacturing plants may only operation 1-2 days per week in response to rising global coal prices

- This will have a dramatic effect on supply chains that source goods from China

- We anticipate container prices will plummet in October as the flow of goods from China dries up

- Two major typhoons in recent months have temporarily shut down entire regions

- Efforts to control the spread of the Delta variant has led to a sharp decrease in manufacturing capacity in China, Vietnam, and Malaysia

- Domestically, things aren’t a whole lot better

- Offshoring has decimated America’s capacity to manufacture most things at home

- Many of the products that are made in the U.S. use raw materials or components that are manufactured overseas

- Companies that want to expand their capacity to manufacture or store more inventory are facing shortages of their own

- Building material shortages

- Warehouse shortages

- Capacity restrictions

- Labor shortages

Why can’t I get space on a vessel and why have rates skyrocketed?

Competition amongst shipping lines is virtually nonexistent due to consolidations in the industry. The consolidation was driven by a number of bankruptcies in the shipping sector during the recession of 2015. Now there are only 3 major alliances:

- The Alliance: Ocean Express Network (ONE), Yang Ming, Hapag-Lloyd, and Hyundai Merchant Marine

- 2M: Maersk (the largest in the world) and MSC

- The Ocean Alliance: OOCL, COSCO, CMA CGM, and Evergreen

The consolidation resulted in reduced capacity as the number of vessels in circulation was reduced by vessel sharing amongst the alliances.

Bottlenecks are exacerbating these capacity constraints and pushing transpacific freight rates to all-time highs. With demand at an all-time high, shippers have had to outbid and outmaneuver competitors for shipping space.

Many importers have lost out on space by failing to act promptly once a quote has been sent. In the past an importer could take 2 days to decide on a sailing or pricing, but in today’s market, if you don’t book the space immediately, either the space has already been taken by another shipper or the spot rate has increased.

Why does my cargo keep getting rolled?

The severe port congestion has led to many vessels waiting weeks to berth, which causes a domino effect. If the vessel can’t make it back to origin in time for a scheduled sailing, the sailing has to be blanked. Carriers then roll cargo from the next sailing to make space for premium cargo that wasn’t able to be shipped due to the blank sailing.

Why can’t I get a box? And when do you think the situation will be resolved?

Exceptionally strong market demand led to a shortage of shipping containers on certain trade lanes.

Thousands of shipping containers are still stuck in the wrong place – either stacked up at inland freight hubs across the U.S., Europe, and Southeast Asia, as carriers make more profits from higher-priced Chinese export than on backhauls, or abandoned in Africa, South America, Australia, and New Zealand, as carriers prioritize their most profitable Asia-North America/Europe routes. Thousands more are stranded at sea, waiting for a terminal berth, and many more have been left sitting for weeks at full warehouses and customer facilities waiting to be unloaded.

Some of the misalignment is also caused by double ordering, double booking, or using the COVID situation to try to build up inventory.

Since the onset of the pandemic, supply chain strategies have evolved from lean, just-in-time inventories, with the emphasis on cost reduction, to building more resilient supply chains that are geared to withstand shocks. By mid-2022, supply chain managers will find they are carrying too much inventory and will still stop placing new orders until inventory levels even out. Once the demand for goods subsides, the supply chain will even out.

What’s driving port congestion?

Origin

- China’s “zero tolerance” COVID policy

- Partial shutdowns in Ningbo and Yantian after minor COVID outbreaks

- Several Chinese ports faced mounting congestion as vessel calls were diverted

- Cargoes have been piling up at the ports due to tight labor force

- Cargo processing has slowed due to stricter disinfection measures

- Crews are required to have health certificates or negative tests before allowing them to load/discharge cargos

- Consolidation in the shipping sector changed how vessels are routed

- Instead of direct sailings, they now go through hubs, like Shanghai, Ningbo, Hong Kong, and Yantian, which adds to the port congestion in China

- Temporary closures of key export hubs after two typhoons made landfall on China’s southeast coast

- Blank Sailings

- Carriers have blanked sailing to other markets for redeployment to the more lucrative trans-Pacific market

- Severe port congestion at destination is preventing vessels from returning to origin on time, forcing carriers to cancel voyages

Destination

There are multiple factors that are driving chronic port congestion at the major U.S. ports, including:

- Increased volumes

- Introduction of Ultra Large Container Vessels (ULCVs), which require more time and resources to unload

- ULCVs can carry up to 15,000 TEUs vs. the standard of 7,000 – 8,000 TEUs

- Longshoremen labor shortages

- COVID protocols

- Social distancing mandates

- Capacity restrictions

- Equipment sanitizing

- Limitations on land

- Trucking

- Rail

- Warehousing

- Equipment shortages

- Lack of port automation

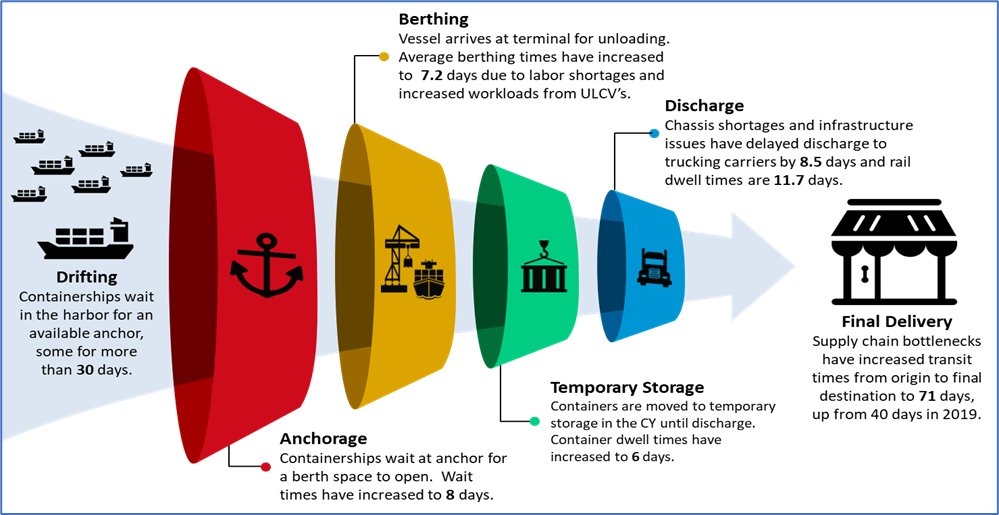

The Southern California gateway is acting like the narrow tube on a funnel, as shown in the illustration below. As large volumes of containerships pour in from Asia, they can only flow into the ports at a certain velocity due to landside limitations.

Illustration: Port Congestion Funnel

Illustration: Port Congestion Funnel

The record back-ups in Los Angeles and Long Beach have effectively removed an estimated 20%-25% of transpacific capacity, and the chaos is costing millions of dollars in delays to ships and cargo.

Why haven’t they cleared the backlog yet?

- Lack of harmony between supply chain partners

- Shipping lines

- Terminals

- Equipment

- Delivery (trucking and rail)

- The ports do no run 24/7/365 like their counterparts in Asia do

- Truckers, rail lines, and warehouses also do not run 24/7, so they would all have to work in concert together to work through the congestion

- The Ports of LA and Long Beach just announced they are extending operating gate hours in a bid to reduce port congestion

- The Port of Long Beach is taking the first step towards a 24/7 supply chain by maximizing night-time operations

- The Port of LA will expend weekend gate opening hours

- Truckers have Hours of Service (HoS) regulations

- FMC regulations limit the number of hours a trucker can drive, which includes the time spent waiting in line to access the freight

- Truckers face fines and shutdowns of service for HoS violations

What are the driving factors behind the chassis shortage?

The primary factor is the sheer volume of containerized cargo that has been flooding into the U.S. since the fall of 2020. Other contributing factors include:

- Port restrictions on empty returns are delaying the return of chassis

- The average street dwell times have increased to 7+ days, meaning that a good portion of chassis are stuck at warehouses and trucker lots for more than a week

- Customers have regularly taken more than 11 days to return chassis

- Thousands more have been taken out of service for maintenance and repairs, but there is currently a shortage of mechanics to repair them

Steamship lines used to be in charge of chassis pools, but a few years ago they said no more, leaving truckers to find their own chassis. But a lack of chassis pools is making it difficult for truckers to find available chassis. Some of the larger ports have recently created – or are in negotiations to create – chassis pools to help alleviate the situation.

While building more chassis seems the logistical solution, it’s not as easy as it seems. It takes a long time to build new equipment, and the manufacturers in China just can’t keep up with the influx of chassis orders. And, the chronic port congestion will only delay delivery of new chassis.

Why don’t the carriers go to smaller ports to alleviate the congestion?

Many importers are still prioritizing Los Angeles and Long Beach due to the convenience of splitting arriving goods between the large consumer base in Southern California and rail links that offer direct transport to the rest of the U.S. through inland hubs.

Some cargo ships have been diverted to other West Coast ports, but nearby ports like Oakland and Seattle do not have the capacity to deal with the large volumes and would be quickly overwhelmed taking on even a small portion of ships from L.A. and Long Beach.

Some shippers have shifted freight to Gulf Coast and East Coast ports, but the ports in Houston, Savannah, and New York have also reported record congestion and weeks of delays. Those alternatives also come with other drawbacks, including adding weeks to transit times and the added expense of the longer voyages.

The ships just aren’t coming to the Port of Boston. We usually see one or two ships a week, and they are using feeder vessels to get to New York quickly.

The smaller ports across the country also have greater limitations with trucking equipment, warehouse space, and labor.

Can’t We Stem Flow from Origin to Relieve The Backlog?

Slowing down these ships is something thought about in the early days of the surge to try to give a little bit more time in between to get ready for the next ships.

But if you start looking at slowing down these ships, it’s going to back up the vessel supply chain even further and make schedules an even deeper concern for liner companies.

So, unfortunately, no.

China’s Golden Week holidays (Oct. 1-7) may give some respite with container lines blanking a number sailings for this period.

When will the backlogs be resolved?

Prior to COVID, companies employed just-in-time inventory management strategies to increase efficiency and decrease waste. To mitigate COVID-related supply chain disruptions, importers had to change that model and began ordering more product and storing inventory, increasing the demand for transport, equipment, and warehouse space.

By mid-2022, supply chain managers may find they are carrying too much inventory and will still stop placing new orders until inventory levels even out. When the demand for goods finally subsides, the supply chain crisis might be resolved.

It’s been reported that global inventories levels have decreased by 10 – 12 days’ worth of supply – an all-time low – in the last year or so since COVID hit, yet demand for warehouse space is at an unprecedented levels. If so much warehouse space has been taken up, how are we out of stock? And who is keeping all of this inventory?

The existential driver behind the demand for warehouse space is the boom in eCommerce spend, as Amazon and other large online retailers gobble up warehouses across the U.S. Consumer spending has increased 10% and is at an all-time high. Restrictions, stimulus checks, and an increase in unemployment benefits led to a change in consumer spending habits from services (travel, entertainment, salons) to goods, as well as a switch from brick & mortar to eCommerce.

Online retail giants, such as Amazon, and the big box chain stores tend to have more product than the little guys. The larger stores, like Walmart, Home Depot, and Costco, are chartering their own ships and they have their own chassis. They likely even have influence at the ports.

We are hitting the peak Christmas season. Are there any dynamics we need to be aware of going into the holiday season?

Many of our clients have already received their Christmas inventories and have placed their spring orders ahead of Chinese New Year. Celebrations of Chinese New Year traditionally last for 16 days, from New Year’s Eve to the Lantern Festival. In 2022, that is from January 31 – February 15. In 2022, it is anticipated that, while many factories will close so that the people can go home to be with their families for the holidays, some will be staying open to accommodate the rush in orders.

Between now and Chinese New Year, capacity is expected to remain very tight. Advance bookings for both air and ocean are still very strong. Freight rates are expected to remain high due to the increased demand.

The shipping lines are posting significant profits at the expense of shippers and consumers. What can be done to break the cycle?

The shipping lines have made more money in the first three quarters of 2021 than they did the in the past 3 years combined – to the tune of many billions of dollars – and they are so proud of their gains, they are posting them all over the place. The price gauging is hurting businesses, consumers, and the economy and is driving up inflation.

They are making significant margins and demand is not going to abate, so there is no incentive for them to reduce prices or increase capacity.

They will continue the cycle until shippers as a group or the government begins to push back, the economy slows down, a recession or other significant world event slows things down for them, or we have a year without any COVID outbreaks and things go back to normal.

CMA CGM and Hapag-Lloyd recently announced that they will suspend spot rate increases through February 1, 2022 in order to prioritize long-term relationships with customers. But sadly Hapag-Lloyd announced a peak season surcharge of $2,000 per 40’ container just a few days later. Scandalous!

In today’s market, is there any benefit in shipping LCL vs. FCL?

There are a few important considerations to keep in mind when considering LCL:

- LCL rates have increased in conjunction with FCL rates

- FAK rates are very high

- LCL shipments require additional processing time – both at origin and destination

- If you have an FCL shipment that gets rolled, the LCL processing time may be about the same

- The lack of warehouse availability for consolidation/deconsolidation may also impact delivery schedules

- Many logistics service providers are unwilling to accept LCL cargo due to space allocations

- LCL shipments are just as likely to be rolled as FCL shipments

- Demand for LCL has increased as shippers who are unable to secure FCL space have opted for LCL

- There is a lot more handling involved in LCL shipments, which increases the risk of damage

With all the troubles in the shipping sector, is there any benefit in switching to air?

If a shipper is spending $25,000 or more for ocean freight plus trucking expenses, air freight might be an option as it’s not much more expensive. One benefit of air freight is that there isn’t much of a difference in cost between flying from China to Los Angeles versus to New York.

One thing to keep in mind is that there is a much bigger limit on air cargo – both for passenger planes and cargo-only aircraft – due to severe international air travel constraints.

We are seeing more and more air charters this year as shippers struggle to bring in their goods, and we recently did six charters on passenger aircraft because there wasn’t enough space on cargo aircraft.

Is the rate trend from the U.S. to Europe in the same predicaments as inbound from Asia?

The skyrocketing freight rates are mostly happening on the Asian trade lanes. This is due to higher demand for goods from Asia, who supply 90% of goods worldwide. Supply vs. demand is the real key to it.

Exports from the U.S. and Europe are a little more solid. Rates have gone up since the pandemic hit, but they certainly haven’t gone up as dramatically.

What is the government doing about excessive Demurrage and Detention (D&D) charges?

In the wake of complaints that shipping lines are overcharging customers, President Biden signed an executive order on July 9 asking the Federal Maritime Commission (FMC) to “ensure vigorous enforcement against shippers charging American exporters exorbitant [D&D] charges”

The FMC voted in mid-September to push forward on two D&D initiatives:

- To issue a policy statement on the issues that affect the ability of shippers, truckers, and others to obtain reparations for conduct that violates the Shipping Act

- Who may file a complaint with the commission alleging unreasonable conduct

- When attorney fees may be imposed on a non-prevailing party

- The scope of the prohibition against carrier retaliation

- To issue an Advance Notice of Proposed Rulemaking which would solicit public comments* on two questions relating to proposed new minimum standards required from carriers and terminal operators on D&D billing

- Should carriers and terminal operators include certain minimum information in D&D billings?

- Should carriers and terminal operators be required to adhere to certain practices regarding the timing of D&D billings?

_______________

*The FMC has not yet announced timing for the public comment period.

Why am I being asked to provide a forecast of my shipping needs? How far out should I be forecasting?

We are asking for 4-5 month forecasts to see what’s coming down the pipeline. This will give us a better opportunity to book the space you need in order to bring your goods here on time to meet your numbers. Space should be booked 4-6 weeks in advance, and your suppliers need to be able to meet those deadlines.

Is there a penalty for missing a booking?

Both the shipping lines and airlines impose penalties for missed bookings, which could run as high as the cost to move the freight. Therefore, you must be very careful when preplanning and forecasting. Prior to booking, we advise you check with your suppliers to ensure they will be able to meet the deadline.

How soon can I have my freight sent to the terminal?

As this is a moving target, it is important to check with us to determine when your freight should arrive.

Please be aware that carriers will charge storage fees for shipments arriving at terminals earlier than the suggested delivery times.

The carriers have also warned that they do not have enough space to store cargo due to congestion.

What can we expect for the remainder of 2021?

We anticipate the end of the year is going to be consistent with what we are seeing now – extremely high demand, tight space, and elevated rates. Chronic port congestion will lead to more blanked sailings and more cargo rolls.

What lessons have shippers learned from the supply chain crisis?

The supply chain crisis has highlighted the need for multiple-tier transparency to:

- Identify supply chain vulnerabilities

- Determine if and where alternative sources are needed

- Ascertain where resources are best deployed

How did we get here?

The COVID-19 pandemic altered the very fabric of our lives, from the millions of people who have been infected and the countless lives of loved ones lost, to the way we live and work. Early efforts to curb the spread of the virus resulted in lockdowns and restrictions, forcing millions of businesses to shutter and others to work from home. Long lines and panic buying at local stores quickly emptied shelves and decimated inventories. Record numbers of critically ill patients overwhelmed hospitals and quickly depleted inventories of life saving medical equipment and personal protective equipment (PPE).

- Lockdowns and Restrictions

- Non-essential businesses – including manufacturers – were forced to shutter

- Essential businesses – including the shipping industry – had to operate at reduced capacity in order to curb the spread of the virus

- Capacity Cuts

- Ocean Freight

- Ocean carriers cancelled sailings after manufacturing in China shut down

- When manufacturing was brought back online in March 2020, carriers began operating at reduced capacity

- Air Freight

- Restrictions on passenger travel led to shortages of air freight capacity, which is flown in the belly of passenger aircraft

- The industry evolved to meet the challenge and converted the passenger cabins into freight holds

- Ocean Freight

- Inventory Replenishment

- Shippers, who were deprived of the regular services that fed their supply chains, ordered more goods to refill their severely depleted inventories

- Growing Business Demand

- Supply chain strategies have evolved from lean, just-in-time inventories, with the emphasis on cost reduction, to building more resilient supply chains, such as keeping more inventory on hand, that are geared to withstand shocks

- Increased Consumer Demand

- Restrictions and stimulus checks led to a change in consumer spending habits

- From services to goods

- From brick & mortar to eCommerce

- Spending on consumer goods is at an all-time high – up 10%

- Restrictions and stimulus checks led to a change in consumer spending habits

By late 2020, real cracks in the supply chain started to emerge. Carriers, who were very cautious about restoring capacity, suddenly added 24% more floating capacity, which only intensified the problem. By September, the backlog was too much to handle and the system was completely flooded.

The shipping industry still hasn’t caught up with demand.