Nearly 200 China List 1 and List 2 Products Now Subject to Tariffs, Other Exclusions Extended

Nearly two hundred products imported from China on List 1 and List 2 are now subject to the additional 25% Section 301 tariffs after the ... Read More

Hundreds of China List 1 and List 2 Products Now Subject to Tariffs, Other Exclusions Extended

Hundreds of products imported from China on List 1 and List 2 are now subject to the additional 25% Section 301 tariffs after the Office ... Read More

WTO Says U.S. Violated Trade Rules When It Imposed Tariffs on Imports from China

The World Trade Organization (WTO) said that President Trump’s imposition of tariffs on $400 billion worth of imports from China violated international trade rules. In ... Read More

U.S. Drops 10% Tariffs on Aluminum Imports from Canada

Just weeks after reimposing tariffs on non-alloyed unwrought aluminum products from Canada, the Office of the U.S. Trade Representative (USTR) announced it will drop the ... Read More

Legal Challenge to China Lists 3 and 4 Tariffs May Result in Refunds, But Fast Action Required

A recently filed lawsuit may result in refunds of Section 301 tariffs levied against all List 3 and List 4A goods from China, regardless of ... Read More

Most China List 4A Goods Now Subject to Tariffs; Others Granted an Extension

The Office of the U.S. Trade Representative (USTR) announced that a number of product exclusions to the Section 301 additional 7.5% tariffs on List 4A ... Read More

Tariffs on Imports from EU Slightly Modified

The Office of the U.S. Trade Representative has announced revisions to the list of imports from the European Union which are subject to the additional ... Read More

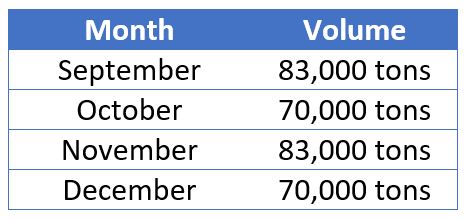

Trump Reimposes Aluminum Tariffs on Canada; Canada Threatens to Retaliate

President Trump has reimposed an additional 10% tariff on non-alloyed unwrought aluminum products from Canada, effective August 16, 2020. In addition, no drawback will be ... Read More

Sporting Goods, Toys Among New China List 4A Tariff Exclusions; Retroactive Refunds Available

The Office of the U.S. Trade Representative has announced 10 additional product exclusions from the additional 7.5% Section 301 tariffs on List 4A goods from ... Read More