If your business imports or exports its products, you invest in your future every time you ship cargo. Surprisingly, many shippers try to save a little money by not insuring their cargo, and, unfortunately, many have paid heavily for it in the end.

To help you decide whether or not to insure your cargo, you need to assess the likelihood that the item may be lost, damaged, or stolen. For high-value items, this may be an easy and straightforward decision, but there are many other factors to consider.

Consider the Risk

Consider the Risk

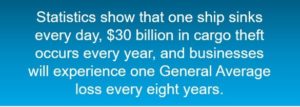

While your logistics partners make every effort to oversee the safe movement of your cargo, there is always the potential for loss or damage due to the perils of extreme weather, rough handling, theft, and many other unforeseen occurrences.

General Average

2019 began with a series of major shipping accidents, including fires onboard the Sincerity Ace, Yantian Express, and APL Vancouver, the sinking of the Grande America, and a major container overboard incident on the MSC Zoe. All of these vessels except the MSC Zoe declared General Average, a contractual obligation of each shipper onboard to pay a portion of the expenses to save the vessel and its cargo.

General Average claims are a huge risk for shippers even if their cargo is undamaged. In recent General Average incidents, shippers have paid upwards of 60% of the value of their cargo before the steamship line released their undamaged cargo. On top of that, shippers with undamaged cargo could face extreme delays in obtaining their containers and could also incur penalties or chargebacks from their end buyers.

Cargo Theft

Cargo theft is seen as a low-risk, high-reward crime by would-be thieves. CargoNet reports that the average loss per incident is $254,800, with food and beverages being the most targeted, followed by electronics and home & garden products. Additional consequences of cargo theft include the cost of replenishment, lost sales, and fraudulent refunds.

Cargo Damage

As common as cargo theft or loss has become, even more common is cargo damage. Cargo can be damaged at any stage of a shipment cycle: while in the possession of the seller, while being packed into a container or loaded onto a truck, during transit by air, sea, road or rail, or during offloading at final destination. Damage may be caused by accidents, load shifts, water, fire, contamination, storms, or acts of God.

Consider Who Carries the Responsibility

While suppliers are responsible for arranging cargo insurance for your shipments, it doesn’t mean that they are ultimately responsible if your product is lost or damaged during transit. And more often than not, the insurance that suppliers place on your cargo will not fully cover the loss, damage, or theft of your commodity while in transit.

Freight forwarders are not responsible or liable for loss of or damage to your cargo, nor can they advance money on a claim or accept deductions on services performed.

If damage or loss does occur, you, the shipper, will need to prove that the carrier was at fault, that the loss occurred while the shipment was in the carrier’s care, control, and custody, and that the carrier was negligent in handling your shipment. Proving liability with the airlines can be almost impossible with truckers and freight handling facilities on either end. For truckers, their liability is limited to losses that they are negligent for – so acts of God like an icy road, theft from a locked trailer, or an accident caused by a third party are not typically covered.

Even if you can prove that the carrier was at fault, you may still not get reimbursed for the full value of your goods. Carriers are only responsible by law to insure your shipments with coverage under the carriers’ Limits of Liability, which are limited to:

- $500 per container for Ocean Carriers

- $0.50 per pound for Domestic Air Carriers or Truckers

- $9.07 per pound for International Air Carriers

Consider What Happens to Non-insured Cargo in the Event of Loss, Theft or Damage

Should you decline insurance coverage for your shipment, you are taking the risk that you will not be able to seek repayment for the cost of your lost or damaged shipment, and you will then have to pay to reship replacement goods.

If General Average Has Been Declared

Shippers who do not take out a cargo insurance policy and who are unable to provide adjusters with the acceptable security could find their cargo auctioned off to recover the residual value of the cargo or be sued for costs and consequences.

For the unlucky shipper whose cargo has been damaged, they are limited to the Carriage of Goods by Sea Act that limits a carrier’s liability to just $500 per customary shipping unit. What’s a ‘customary shipping unit’ you ask? It could be a full 40’ ocean container.