This year’s peak shipping season looks to be getting an earlier start than usual. According to the National Retail Federation, monthly U.S. import volumes are expected to reach the two million TEU mark by the end of May before cresting at 2.1 million TEUs in August.

This year’s peak shipping season looks to be getting an earlier start than usual. According to the National Retail Federation, monthly U.S. import volumes are expected to reach the two million TEU mark by the end of May before cresting at 2.1 million TEUs in August.

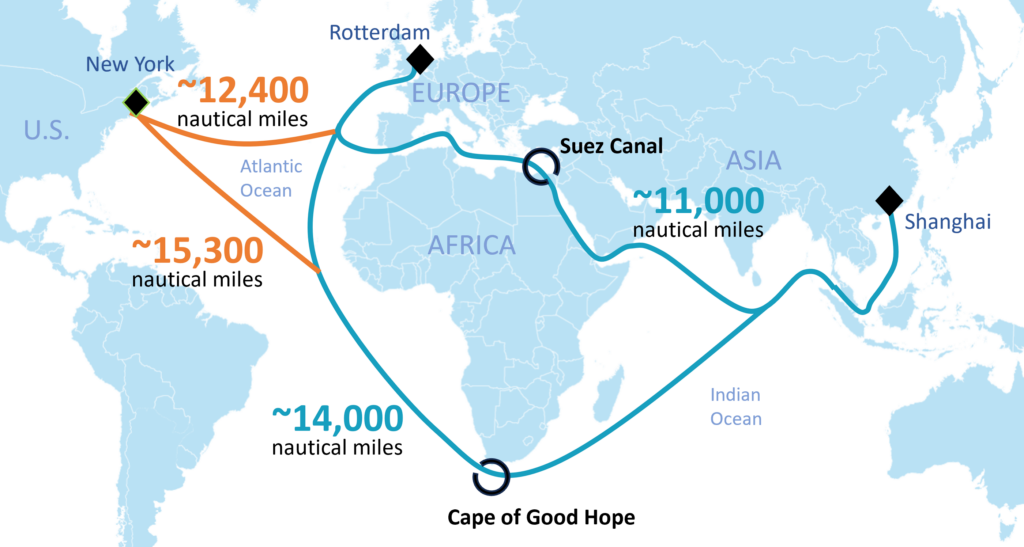

This year, however, experts are warning that it will be earlier and tougher than ever due to a number of contributing factors, including geopolitical turmoil, disruptions in the ocean freight sector caused by the Red Sea crisis and Panama Canal drought, and surprisingly strong air and ocean freight volumes despite the global inflationary pressures.

Peak season shipping always presents unique challenges for shippers, but with proper planning and execution, shippers can successfully navigate this busy period. In this post, we’ll explore some valuable tip to help you avoid costly delays, increase turn times, and reduce costs.

Plan Ahead

One of the most critical steps in preparing for the peak season is to plan ahead. Start by analyzing your historical data to forecast demand and identifying potential supply chain bottlenecks. By understanding your shipping needs in advance, you can secure capacity and avoid last-minute rush fees.

Secure Capacity in Advance

Shippers are advised to book consignments as early possible in order to secure space and avoid shipping 45’ HC containers, if possible, as these are more likely to be rolled. Also, be mindful that ports and warehouses are likely to be extremely congested so expect more time to load / unload at point of origin and destination.

Communicate Proactively

Clear and proactive communication with your suppliers is critical for managing expectations and addressing concerns or potential delays. Suppliers should provide you with timely updates on order status, shipping times, and delivery windows.

Freight forwarders, such as OCEANAIR, are your greatest allies in helping you navigate the turbulent the peak season. Communicate early and often with your freight forwarder and provide them with insight into your shipping forecasts, required delivery dates, and purchase orders so that they can advise you on the best routing options and the most appropriate lead times.

Be Flexible

Consider choosing a service with a slightly longer transit time. The fastest transit time services are more likely to be overbooked, which increases the chances for having a shipment rolled.

Prepare for Potential Disruptions

As we’ve all witnessed over the last four years, unforeseen challenges and disruptions do occur, despite careful planning. Shippers should have contingency plans in place to address potential issues such as weather-related delays, capacity constraints, or other supply chain disruptions. By preparing for contingencies in advance, companies can minimize the impact on their operations and maintain customer satisfaction.

Prepare to Pay for Extra Fees

Peak season surcharges (PSS), bunker surcharges, emergency bunker surcharges (EBS) imposed by several of the world’s top shipping lines due to rising fuel prices, and general rate increases (GRI) are driving up costs for all modes of transport. Congested ports mean longer wait times for truckers, who will charge wait fees and port congestion fees. Some ports and rail ramps may also apply chassis split charges if they experience chassis shortages.