AUSTRALIA’S NEW IMPORT GST TAKES EFFECT 1 JULY 2018

As of 1 July 2018, a new goods and services tax (GST) will be applied to retail sales of low value physical goods ($1,000 or less) that have been imported to Australia and sold to consumers. The GST is a broad-based tax of 10% on most goods, services, and other items sold or consumed in Australia. This will affect goods valued at A$1,000 or less on items such as:

- clothing

- cosmetics

- books

- electric appliances

What does this mean for my business?

If your business meets, or is likely to meet, the A$75,000 GST registration threshold (A$150,000 GST for non-profit organizations) and sells low value physical goods that are imported to Australia, you will need to:

- Register for GST no later than 1 July 2018

For more details, please visit https://www.ato.gov.au/business/gst/registering-for-gst/#Howtoregister.

- Charge GST to customers on low value exported goods (unless they are GST-free)

- Lodge a return to the Australian Tax Office (ATO)

If your business does not fit into either of the categories above, you are not required to register for GST.

The Australian Taxation Office has created a compliance division that will be responsible for:

-

-

-

- Supporting Compliance. The ATO will support sellers that have taken reasonable steps to meet their legal obligations.

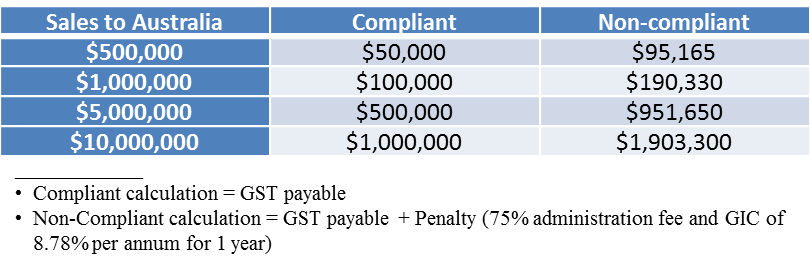

- Penalizing Non-Compliance. Non-compliant sellers will incur an additional 75% administrative penalty plus general interest charges (GIC) on outstanding amounts after the first year. Please refer to the table below for same penalties that may be incurred.

- Retrieving Information. The ATO has made arrangements with other countries to share information to identify the legal entity behind e-commerce websites and obtain third party credit card transactional data to track purchases.

- Monitoring. The ATO collects information for all parcels entering Australia via importers as well as the postal channel (through S10 barcode)

- Recovering tax claims. The ATO has the power to recover outstanding taxes via foreign governments under The Multilateral Convention on Mutual Administrative Assistance in Tax Matters.

-

-

The existing processes to collect GST at the border on imports above $1,000 remain unchanged.

For more information, please visit the Australian Taxation Office’s website at https://www.ato.gov.au/General/New-legislation/In-detail/Indirect-taxes/GST/GST-on-low-value-imported-goods.