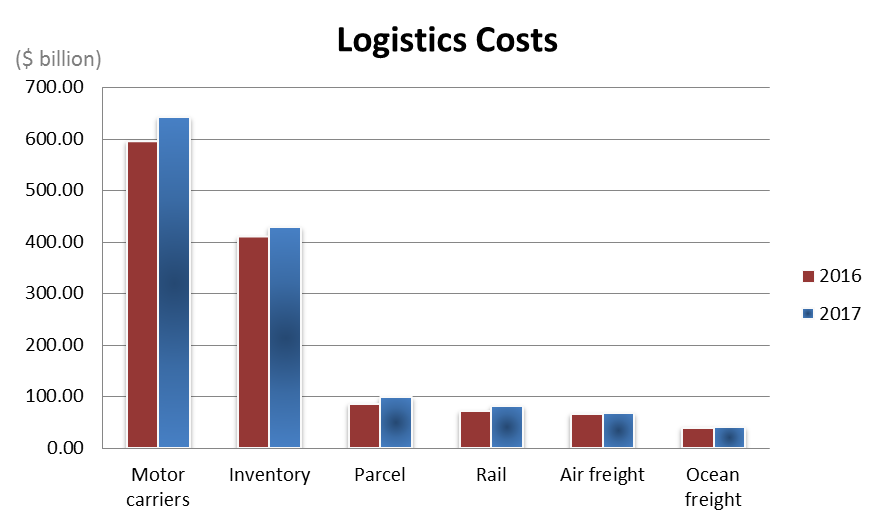

According to the State of Logistics Report published by the Council of Supply Chain Management Professionals, U.S. companies spent $1.5 trillion on shipping costs in 2017, up 6.2% from the prior year. Motor carrier costs rose 7.8%. Rail and air costs also rose, 8.2% and 3.1% respectively. Ocean freight had the lowest cost increase of 1.1%. The report also noted “strong demand and higher interest rates also lifted the cost of carrying inventory last year. Inventory financing expenses rose 5% and storage expenditures increased 4.2%”.

Sean Monahan, a constant with A.T. Kearney, tells the Wall Street Journal that the freight market was showing signs of picking up after nearly two years of excess capacity and that shippers were caught off guard when prices started to rise.

John Manners-Bell, Chief Executive Officer at Transport Intelligence, a consultancy firm based in Bath, England (http://www.ti-insight.com), notes that e-commerce is having an equally important impact on warehousing, leading to vast investments in the construction of new facilities as well as an increase in the number of outsourced warehouse facilities that are popping up across the Americas and Asia-Pacific. Mr. Manners-Bell also added that “Costs across all freight transportation sectors around the world will continue to rise in 2018, and the most successful companies will be those who are able to mitigate their impact on their profitability, and that there’s little doubt that technology will play an important role in this by driving efficiencies”.

The Numbers

U.S. business logistics costs increased in 2017 after falling in 2016. The sharpest spending increase was a 9.5% rise in dedicated trucking costs. Less-than truckload freight costs rose significantly less at 6.6%, while full truckload rose 6.4%.

A Perfect Storm

What caused such a dramatic increase in freight transportation costs? A perfect storm of events… The main drivers being a booming economic climate, a strong job market, rising wages, and truck driver shortages. Hurricanes in the Gulf Coast and Puerto Rico strained logistics networks as transportation providers scrambled to deliver relief supplies. A few weeks later, the mandate enforcing electronic logging devices (ELD) took effect, forcing trucker drivers to log their driving hours and dictating how much time can be spent behind the wheel. Added to that, fuel costs rose by 30%. E-commerce sales also drove up parcel delivery costs due to increased shipping volumes and residential deliveries shifted business away from traditional logistics operations, pushing up the volume by 7% to nearly $1B.

Forecast for the Remainder of 2018

The continuing truck driver shortage could result in less availability of trucks as well as slower delivery times for American businesses as well as consumers who are increasingly ordering goods and services online. Domestic trucking is responsible for transporting 70% of consumer goods sold in the U.S. according to American Shipper.

A period of uncertainty caused by U.S. renegotiations of the North American Free Trade Agreement and the looming trade wars with China, Mexico, Canada, and the EU can have a tremendous effect on the overall global economy and stir demand for logistics services.

As demand continues to soar, businesses are finding themselves spending more money on transportation and warehousing, and demand isn’t showing any signs of slowing down. The Wall Street Journal is predicting that this current trend in trade is likely to continue as is, but that it will cost U.S. companies more.

Tips for Weathering the Storm

- Take control over your freight; do not consent to vendor-controlled freight, which can cost you 20% more than if you negotiated your shipping rates and routes

- Do your homework; understand your volume, shipping characteristics, and ground minimums (just to name a few)

- Consider using a freight forwarder who can orchestrate the fastest and cheapest means of moving your goods with reduction in costs of 15% – 25%

- Develop broader contracts with your carriers to guarantee capacity. It is important to note that freight companies have been turning down loads due to driver shortages.

- Get audited invoices and consolidated billing

- Implement:

- IT supply chain solutions to provide more timely and accurate information (big data and predictive analytics)

- Vendor value-added service solutions to reduce costs and speed product through the distribution center

- Vendor compliance measures to assist product flow through your distribution centers and make compliance a top priority for your supply chain

- Prepare risk mitigation plans and consider alternative strategies for protecting profit margins

- Build transportation into facility designs

- Outsource warehousing and distribution functions

- Utilize return services in order to process returns more efficiently and provide customer service support

- Consider investing in emerging technologies such as artificial intelligence, robotics, crowdsourcing and autonomous vehicles